how are property taxes calculated in broward county florida

Please note that we can only estimate your property tax based on median property taxes in your area. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

After registration is complete you can also pay taxes online.

. Records Taxes and Treasury Division Taxes And Fees Property Taxes. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. 24 Step Number 7.

21 Step Number 4. Home Sale Price Deed Doc Stamps. Search and Pay Property Tax.

Pay Tourist Tax. Florida property tax calculator. 4 discount if paid in November.

Knowing how to calculate your property tax expense is important in knowing whether you can afford a particular home. When it comes to real estate property taxes are almost always based on the value of the land. Florida relies on property tax revenues a lot.

Find the assessed value of the property being taxed. Enter a name or address or account number etc. Property taxes have always been local governments very own domain as a revenue source.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Broward County Tax. How Property Tax is Calculated in Broward County Florida. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

Enter Any Address Receive a Comprehensive Property Report. Based on that rate and Broward Countys median home value of 247500 you can expect to pay an average of 2664 a year in property taxes in Broward County. Broward County Property Appraisers Office - Contact our office at 9543576830.

Florida counties rely on the real property tax to fund governmental services. Property Tax Broward Payment by Credit Card. Houses 1 days ago The median property tax in Broward County Florida is 2664 per year for a home worth the median value of 247500.

The Estimated Tax is just that. Under Florida law e-mail addresses are public records. If you do not want your e-mail address.

The median property tax in Broward County Florida is 2664 per year for a home worth the median value of 247500. Under Florida law e-mail addresses are public records. For comparison the median home value in Broward County is 24750000.

Save Transaction Supporting Document. P - Z Property Taxes Renew Registration Sub Agent Listing Tangible Personal Property Tax Taxing Authority Phone Listing Tax Bill information US. You sell your current Florida Homestead that has an Assessed Value of 200000 and a Just Market Value of 350000.

Search and Pay Business Tax. Broward County Florida Mortgage Calculator. Broward Countys average tax rate is 108 of assessed home values slightly higher than the state average of 097.

Broward County collects on average 108 of a propertys assessed fair market value as property tax. Broward County FL Property taxes must be paid no later than March 31 of the following year to avoid delinquency interest fees and penalties but may be paid as early as November 1 of the current year to take advantage of early-payment discounts. Broward County Property Appraisers Office - Contact our office at 9543576830.

Fair lawn high school graduation. Broward County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. The median property tax also known as real estate tax in Broward County is 266400 per year based on a median home value of 24750000 and a median effective property tax rate of 108 of property value.

If you do not want your e-mail address released in response to a public records request do not. Together with Broward County they rely on real property tax receipts to carry out their public services. Property taxes in Florida are implemented in millage rates.

Florida is ranked number twenty three out of the fifty states in. What is the property tax rate in Broward County. Broward County Property Appraisers Office - Contact our office at 9543576830.

22 Step Number 5. Broward County has one of the highest median property taxes in the United States and is ranked 236th of the 3143 counties in order of median property taxes. Cities school districts and county departments in Miami-Dade and Broward Counties may set their own millage all of which are added up to determine the total millage rate.

Funds and drawn on a US. How Property Tax is Calculated in Broward County Florida. Search and Pay Business Tax.

Confirmation of Broward Property Tax Invoice Payment online. If an Echeck payment is submitted with the incorrect account information or returned unpaid for any reason a fee of up to 5 may be charged per Florida Statute 1250105. See Results in Minutes.

Broward County Florida Mortgage Calculator. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home. To calculate the property tax use the following steps.

350000 200000 150000 in Tax Benefit. Base tax is calculated by multiplying the propertys assessed value by the millage rate applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Ad Property Taxes Info.

Base tax is calculated by multiplying the propertys assessed value by the millage rate applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. Property Taxes Broward Payment by E-check. Calculating South Florida Property Taxes.

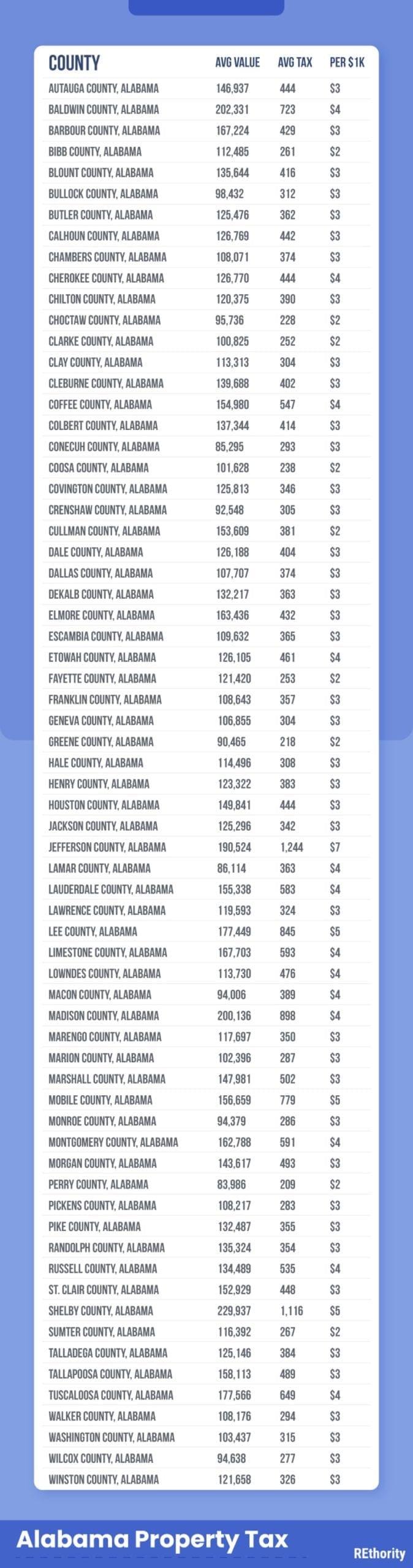

25 Step Number 8. 23 Step Number 6. Tax amount varies by county.

Discounts for payments made in full are as follows. Renew Vehicle Registration. Florida Property Tax Rates.

The millage rate is a dollar amount per 1000 of a homes taxable property value. Credit and debit card payments are charged 255 of the total amount charged 195 minimum charge. Pay Tourist Tax.

The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills. 097 of home value. Payments can be submitted by mail or in person and must be made in US.

You can sort by any column available by clicking the arrows in the header row. Search and Pay Property Tax. Select Option for Broward County Property Tax Online Payments.

Calculation for Deed Doc Stamps or Home Sale Price. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

Free Mortgage Calculator Mn The Ultimate Selection Mortgage Refinance Calculator Refinance Mortgage Refinance Calculator

Property Tax By County Property Tax Calculator Rethority

Broward County Fl Property Tax Search And Records Propertyshark

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Your Guide To Prorated Taxes In A Real Estate Transaction

First Time Home Buyer Rent Vs Buy Calculator Mls Mortgage Mortgage Real Estate Investing Rental Property Free Mortgage Calculator

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Florida Property Tax H R Block

Explaining The Tax Bill For Copb

Why Are My Property Taxes Higher Than My Neighbor S Credit Com

Explaining The Tax Bill For Copb

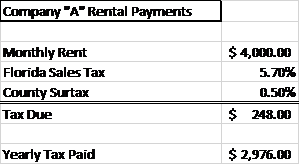

How To Calculate Fl Sales Tax On Rent

Property Tax By County Property Tax Calculator Rethority

![]()

Paying High Property Tax Get The Ways Of Reducing It Property Tax Tax Reduction Tax Consulting

Property Tax By County Property Tax Calculator Rethority

Broward County Fl Property Tax Search And Records Propertyshark